Section 1: Executive Summary

Amazon Web Services (AWS), a subsidiary of Amazon.com, is the world’s most comprehensive and broadly adopted cloud computing platform. It provides on-demand delivery of information technology (IT) resources and services over the internet with a metered, pay-as-you-go pricing model. Since its formal launch in 2006, AWS has fundamentally redefined how organizations of all sizes—from nascent startups to global enterprises and government agencies—procure and manage technology infrastructure. By offering over 200 fully featured services from data centers globally, AWS allows businesses to forgo the substantial capital expenditure and operational complexity of owning and maintaining physical data centers, instead accessing computing power, storage, databases, and a vast array of other technologies as a variable utility.

The immense popularity and sustained market leadership of AWS are rooted in a confluence of strategic advantages that create a powerful, self-reinforcing ecosystem. The primary drivers of its adoption include a revolutionary economic model that transforms capital expenses into operational expenses, providing unparalleled financial flexibility and democratizing access to enterprise-grade technology. This is coupled with profound technical benefits: unmatched agility that allows for rapid innovation, near-infinite scalability to meet fluctuating demand, and the speed to deploy applications globally in minutes. The sheer breadth and depth of its service catalog, which spans from foundational infrastructure to cutting-edge technologies like artificial intelligence (AI) and the Internet of Things (IoT), enable customers to build virtually any application imaginable within a single, integrated platform.

Quantitatively, AWS maintains a commanding lead in the global cloud infrastructure market, holding approximately 30-32% market share. While competitors like Microsoft Azure and Google Cloud are formidable and growing, AWS’s first-mover advantage has endowed it with a mature platform, unmatched operational experience, and the largest community of customers and partners. This ecosystem is further fortified by a culture of relentless innovation and a deep commitment to security and compliance, earning the trust of organizations in the most highly regulated industries.

However, adopting the AWS platform involves significant strategic considerations. The very strengths that make AWS dominant—its vast service portfolio and integrated ecosystem—also introduce challenges. These include a complex pricing structure that demands rigorous financial governance, the strategic risk of vendor lock-in, and a steep learning curve that has created a competitive market for skilled talent. Therefore, for any organization, leveraging AWS effectively requires a deliberate strategy that aligns technology adoption with business goals, embraces proactive cost management, invests in human capital, and architects for both resilience and long-term flexibility.

Section 2: Defining the Cloud Titan: The Architecture and Essence of AWS

To comprehend the scale and impact of Amazon Web Services, one must first understand the paradigm shift it represents. AWS is not merely a collection of products; it is the commercial embodiment of cloud computing, a fundamentally different approach to building and running technology that has become the bedrock of the modern digital economy.

The Cloud Computing Paradigm Shift

At its core, cloud computing is the on-demand delivery of IT resources via the internet with pay-as-you-go pricing.1 This model stands in stark contrast to the traditional, on-premises approach where organizations were required to buy, own, and maintain their own physical data centers and servers.2 Before the advent of the cloud, launching a new application necessitated a lengthy and expensive process of procuring hardware, installing software, and provisioning capacity—often based on peak-load forecasts that resulted in significant underutilization.

AWS pioneered the solution to this inefficiency. Instead of owning infrastructure, businesses can access technology services—such as computing power, storage, and databases—on an as-needed basis from a cloud provider like AWS.1 The central value proposition is the economic transformation of IT spending: trading large, upfront capital expenses (CapEx) for variable operational expenses (OpEx).1 This model eliminates the need for businesses to guess their capacity requirements. They can provision the resources they need in real-time and scale them up or down as their business needs change, focusing their capital and human resources on what differentiates their business, not on the “undifferentiated heavy lifting” of managing infrastructure.4

This shift is more than a technical evolution; it is a business model innovation that has democratized access to powerful technology. The utility-based model allows a startup in a college dorm room to access the same robust, scalable, and secure infrastructure as the world’s largest corporations, leveling the competitive landscape and fueling a global wave of digital innovation.6

Deconstructing the ‘as-a-Service’ Stack

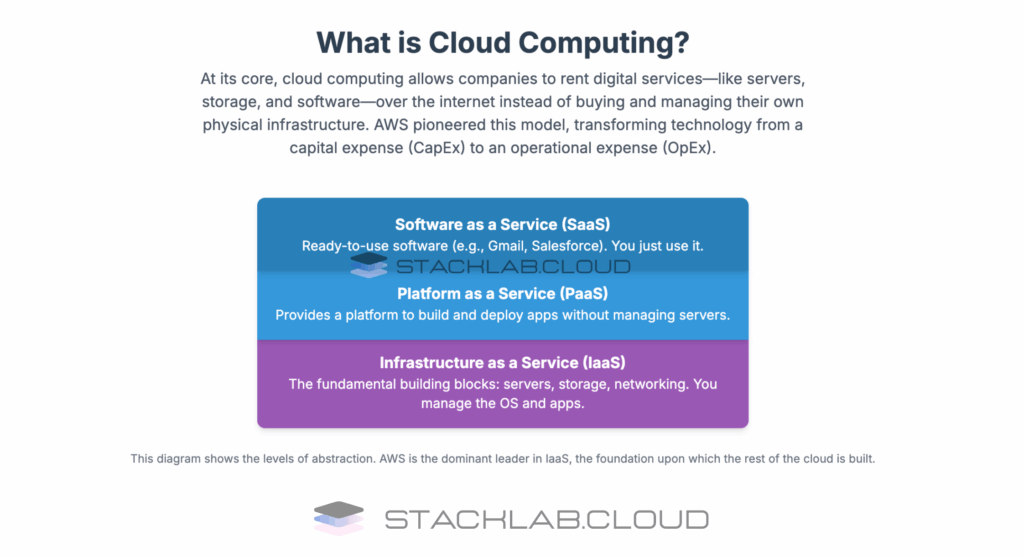

The services offered by cloud providers like AWS are typically categorized into three main models: Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS).

Each model provides a different level of abstraction, control, and management, allowing organizations to select the right set of services for their needs.2 A helpful analogy is to think of these models in terms of housing: on-premises is like building a house from scratch, where you are responsible for everything; IaaS is like leasing the land and utilities to build your own house; PaaS is like renting a furnished apartment where you just bring your personal belongings; and SaaS is like staying in a hotel where everything is managed for you.9

- Infrastructure as a Service (IaaS): This model delivers on-demand access to the fundamental building blocks of cloud IT: computing infrastructure resources such as servers (virtual or dedicated), storage, and networking.5 With IaaS, the customer does not manage the physical data center, but is responsible for managing the operating system, middleware, and their applications and data.9 IaaS provides the highest level of flexibility and management control over IT resources and is the model most analogous to traditional on-premises IT.5 AWS is the undisputed leader in the IaaS segment, with its Amazon Elastic Compute Cloud (EC2) service—which provides scalable virtual servers—serving as the cornerstone of its platform.8

- Platform as a Service (PaaS): This model removes the need for organizations to manage the underlying infrastructure (typically hardware and operating systems), allowing them to focus exclusively on the deployment and management of their applications.5 The PaaS provider handles resource procurement, capacity planning, software maintenance, patching, and other administrative tasks, which significantly increases developer efficiency.5 AWS offers numerous PaaS solutions, such as AWS Elastic Beanstalk, which automates the deployment and scaling of web applications.12

- Software as a Service (SaaS): This model provides customers with access to a complete, ready-to-use software application that is delivered and managed remotely by the provider.8 The provider handles all aspects of the service, including the application code, the underlying infrastructure, and all maintenance and updates.9 Most SaaS applications are accessed directly through a web browser, requiring no installation on the customer’s device.9 While AWS is primarily known as an IaaS and PaaS provider, it also offers some SaaS applications (e.g., Amazon Chime for video conferencing) and, more importantly, its infrastructure serves as the foundation for thousands of the world’s leading third-party SaaS companies.12

The Foundational Pillars of the AWS Ecosystem

The AWS platform is defined by its immense scope, offering over 200 fully featured services from a global network of data centers.13 These services are the building blocks that developers can assemble to create nearly any type of application. While the list is ever-expanding, the services can be grouped into several foundational categories that form the core of the AWS ecosystem.

The tight, seamless integration between these services is a deliberate platform strategy. For example, data stored in Amazon S3 can be used as a source for a big data analytics job in Amazon EMR, which runs on Amazon EC2 instances within a secure Amazon VPC network, with access controlled by AWS IAM.12 This interoperability creates a powerful network effect; the more AWS services a customer uses, the more value they derive from the platform as a whole. This design creates a highly “sticky” ecosystem, where the integrated whole is far more powerful than the sum of its parts, encouraging customers to build their entire technology stack within the AWS environment. This ecosystem effect is a core component of AWS’s competitive advantage and a driver of the vendor lock-in risk that customers must strategically manage.

Table 1: Overview of Core AWS Services

| Service Category | Core Service | Function | Common Use Cases |

| Compute | Amazon EC2 (Elastic Compute Cloud) | Provides scalable virtual servers (instances) in the cloud. | Hosting web applications, running enterprise software, big data processing, gaming servers. 16 |

| AWS Lambda | A serverless compute service that runs code in response to events without provisioning or managing servers. | Automating backend tasks, data processing, creating event-driven microservices. 16 | |

| Storage | Amazon S3 (Simple Storage Service) | Highly scalable and durable object storage for any amount of data. | Website hosting, data backup and restore, data lakes for analytics, media hosting. 16 |

| Amazon EBS (Elastic Block Store) | Provides persistent block-level storage volumes for use with EC2 instances. | Storage for databases, file systems, and applications requiring high-performance disk access. 12 | |

| Amazon S3 Glacier | A secure, durable, and extremely low-cost storage service for data archiving and long-term backup. | Archiving financial records, medical images, and other data that is infrequently accessed. 14 | |

| Databases | Amazon RDS (Relational Database Service) | A managed service that simplifies the setup, operation, and scaling of relational databases. | Powering production databases for web and mobile applications, e-commerce platforms, and CRM systems. 16 |

| Amazon DynamoDB | A fast, flexible, and fully managed NoSQL database service with single-digit millisecond latency. | Mobile apps, gaming, ad tech, and other applications requiring high-performance, low-latency data access. 12 | |

| Networking | Amazon VPC (Virtual Private Cloud) | Enables the provisioning of a logically isolated section of the AWS cloud where resources can be launched in a defined virtual network. | Creating secure, isolated networks for applications; connecting cloud infrastructure to on-premises data centers. 12 |

| Amazon CloudFront | A fast content delivery network (CDN) service that securely delivers data, videos, applications, and APIs to customers globally with low latency. | Accelerating website performance, streaming video, and distributing software. 12 | |

| Security | AWS IAM (Identity and Access Management) | Enables secure control of access to AWS services and resources. | Creating and managing users and groups, and using permissions to allow and deny their access to AWS resources. 8 |

Section 3: The Genesis of Dominance: A Historical and Strategic Evolution

The story of Amazon Web Services is not one of a single invention, but of a strategic evolution born from internal necessity, capitalized upon by visionary leadership, and sustained by a relentless pace of innovation. Its history reveals how a first-mover advantage, when properly exploited, can create compounding cycles of success that build formidable and lasting competitive moats.

The Prelude: An Internal Solution to a Global Problem (2000-2005)

The origins of AWS are deeply intertwined with the operational challenges of its parent company, Amazon.com. In the early 2000s, as Amazon scaled its e-commerce platform and began offering services to third-party retailers like Target, its internal development teams faced significant bottlenecks.3 Each team was building its own infrastructure resources from scratch, leading to inefficiency and slowing down innovation.21 To solve this, the company embarked on a mission to build a set of standardized, automated, and shared infrastructure services that any internal team could access on demand.3

This internal effort culminated in a seminal 2003 paper by Benjamin Black and Chris Pinkham, which described a vision for an infrastructure that was “completely standardized, completely automated, and relied extensively on web services”.20 This was the conceptual blueprint for what they termed an “Operating System of the Internet”—a platform that would abstract away the complexities of hardware and provide core resources like compute and storage as managed services, freeing developers from the “undifferentiated heavy lifting”.4 By 2004, Amazon realized that the powerful infrastructure it was building for its own use could be a valuable product for external customers, and the first official AWS service, Amazon Simple Queue Service (SQS), was launched publicly that year.3

The Launch and First-Mover Advantage (2006-2010)

AWS officially launched to the public in the spring of 2006, a move that would pioneer the modern cloud computing industry.4 The launch was anchored by two foundational services: Amazon S3 (Simple Storage Service) in March, which solved the critical problem of scalable and reliable data storage, and Amazon EC2 (Elastic Compute Cloud) in August, which gave customers on-demand access to virtual computing power.3

This launch gave AWS a crucial first-mover advantage. For several years, it was the only major player offering public cloud infrastructure at scale. Competitors were slow to respond; Google launched its more limited PaaS offering, App Engine, in 2008, and Microsoft launched its comprehensive Azure platform in 2010.20 This multi-year head start was a strategic masterstroke. It allowed AWS to capture a vast and diverse customer base, particularly among startups and developers who were quick to recognize the value of avoiding massive upfront hardware investments.3

This early lead created a virtuous cycle. A large customer base generated significant revenue, which was reinvested into expanding global infrastructure and accelerating research and development. It also provided an invaluable feedback loop, with real-world usage data informing the refinement of existing services and the creation of new ones. This cycle established a momentum that competitors have struggled to overcome. The early and widespread adoption of AWS led to the organic growth of a massive supporting ecosystem, including a large talent pool of AWS-certified developers, extensive third-party management tools, and a wealth of community-generated documentation and tutorials. While a competitor could eventually replicate AWS’s features, they could not easily replicate this mature, multi-year-old ecosystem, a key factor behind customer inertia and loyalty.23

A Timeline of Relentless Innovation

Following its launch, AWS embarked on a campaign of continuous and rapid expansion of its service portfolio. This was not a random collection of product releases but a systematic strategy to build out a complete, end-to-end platform. The following timeline highlights key milestones that demonstrate this deliberate evolution from a basic IaaS provider to a comprehensive technology ecosystem.

Table 2: Timeline of Key AWS Milestones

| Year | Key Service/Milestone | Strategic Significance |

| 2006 | Amazon S3 & EC2 Launch | The official birth of AWS and the modern IaaS market. Provided the two fundamental building blocks of cloud computing: scalable storage and on-demand compute power.3 |

| 2008 | Amazon EBS Launch | Introduced persistent block storage for EC2 instances, a critical feature for running traditional applications and databases, making the platform more enterprise-ready.20 |

| 2009 | Amazon RDS Launch | Launched a managed relational database service, moving AWS up the value chain from pure infrastructure to a platform provider. This abstracted away complex database administration tasks, increasing developer productivity.20 |

| 2009 | Amazon VPC Launch | Introduced Virtual Private Cloud, allowing customers to create logically isolated networks. This was a crucial security and networking feature that gave enterprises the control they needed to migrate sensitive workloads to the cloud.20 |

| 2010 | AWS IAM Launch | Released Identity and Access Management, providing granular control over who can access which AWS resources. This sophisticated security control became a cornerstone of enterprise adoption.20 |

| 2011 | AWS CloudFormation Launch | Introduced a foundational “Infrastructure as Code” (IaC) tool, allowing customers to define and provision their entire AWS infrastructure through code. This enabled automation, repeatability, and version control for cloud environments.20 |

| 2012 | Amazon DynamoDB Launch | Launched a fully managed, high-performance NoSQL database. This demonstrated AWS’s commitment to providing purpose-built tools for modern, large-scale applications beyond the traditional relational database model.20 |

| 2014 | AWS Lambda Launch | Pioneered the “serverless” computing paradigm. Lambda allowed developers to run code in response to events without thinking about servers at all, a revolutionary step in abstracting away infrastructure management.20 |

| 2015 | Amazon ECS Launch | Released the Elastic Container Service, embracing the growing trend of containerization (popularized by Docker) and providing a managed platform for running containerized applications at scale.20 |

| 2017 | Amazon SageMaker Launch | Introduced a fully managed service to build, train, and deploy machine learning models, democratizing access to complex AI/ML technology and signaling a major push into higher-level, value-added services.20 |

| 2023 | Amazon Bedrock Launch | Launched a fully managed service providing access to leading foundation models for generative AI. This positioned AWS as a key player in the next major technological wave, competing directly in the rapidly emerging generative AI market.20 |

Section 4: The Anatomy of Popularity: Key Drivers of AWS Adoption

The sustained dominance of Amazon Web Services is not attributable to a single feature but to a powerful combination of economic, technical, and operational advantages. These drivers are deeply interconnected, creating a self-reinforcing “flywheel” effect that attracts and retains customers, solidifies market leadership, and funds future innovation.

Economic Transformation: From Capital to Operational Expenditure

The most profound driver of AWS adoption is its fundamental restructuring of IT economics. By allowing organizations to trade large, upfront capital expenses (CapEx) for variable operational expenses (OpEx), AWS removes one of the greatest barriers to technological innovation: cost.1 Before the cloud, deploying a new service required significant investment in physical servers, storage arrays, and networking gear, a process that was both costly and time-consuming.3

AWS’s “pay-as-you-go” pricing model completely upends this paradigm.1 Customers pay only for the computing resources they actually consume, with no long-term contracts or upfront commitments required.14 This utility-based approach provides immense financial flexibility. A startup can launch a global application with minimal initial investment, and a large enterprise can experiment with a new idea without a massive budget appropriation.10 Furthermore, because resources can be shut down when not in use, this model inherently drives cost efficiency and eliminates waste from over-provisioning.12 The massive global scale of AWS’s operations creates enormous economies of scale, allowing it to offer these resources at a price point that is difficult for individual organizations to match on their own.4

Unmatched Agility, Scalability, and Speed

Beyond the economic benefits, AWS provides a platform for unprecedented operational velocity. This is manifested in three key areas:

- Agility: In a traditional IT environment, procuring and provisioning a new server could take weeks or months. With AWS, developers can spin up hundreds or even thousands of virtual servers in minutes, dramatically accelerating the pace of innovation.1 This agility allows organizations to experiment more freely, test new ideas quickly, and respond faster to changing market conditions.1

- Scalability: A core feature of the AWS platform is its elasticity—the ability to dynamically scale resources to match demand. Services like AWS Auto Scaling can automatically add or remove EC2 instances based on real-time traffic, ensuring that an application has the capacity to handle sudden spikes (e.g., a viral marketing campaign or a holiday shopping rush) without manual intervention.8 This prevents both performance degradation from being under-provisioned and wasted spending from being over-provisioned.15

- Speed: AWS’s global infrastructure allows businesses to achieve a global reach almost instantaneously. An application can be deployed across multiple geographic regions with just a few clicks, bringing it closer to end-users around the world.1 This ability to “go global in minutes” provides a significant competitive advantage, drastically reducing the time-to-market for new products and services.

The Breadth and Depth of the Service Catalog

A key differentiator that sustains AWS’s lead is the sheer scope of its service portfolio. With over 200 fully featured services, AWS has significantly more services, and more features within those services, than any other cloud provider.13 This comprehensive catalog covers the entire technology stack, from foundational infrastructure like compute, storage, and databases to emerging technologies such as machine learning, artificial intelligence, data lakes, analytics, and the Internet of Things.13

This breadth means that customers can build nearly anything they can imagine using AWS as a single, integrated platform.13 The depth within each service category is equally important. For example, instead of a one-size-fits-all database, AWS offers a wide variety of purpose-built databases—including relational (Amazon RDS), key-value (Amazon DynamoDB), document, and graph databases—allowing customers to choose the optimal tool for their specific application to achieve the best cost and performance.13 This vast toolkit empowers developers and accelerates innovation by providing ready-made solutions for a wide range of technical challenges.

Global Reach and Proven Operational Expertise

Trust in a cloud provider is paramount, and AWS’s leadership is built on a foundation of proven reliability and operational excellence. AWS operates a massive global infrastructure, with significantly more data centers than its nearest competitors.28 This infrastructure is strategically organized into geographic Regions, and within each Region are multiple, isolated Availability Zones (AZs). Each AZ is a fully independent data center with its own power, cooling, and networking, designed to be insulated from failures in other AZs.8 By deploying applications across multiple AZs, customers can achieve high availability, fault tolerance, and robust disaster recovery capabilities with ease.10

This global footprint not only enhances reliability but also improves performance by allowing customers to place their applications in close physical proximity to their end-users, which reduces latency.1 Perhaps most importantly, AWS possesses unmatched experience, having operated its cloud services at a massive scale since 2006. This long history provides a level of operational expertise and maturity that customers trust to run their most critical and demanding workloads.28

A Culture of Security and Compliance

AWS has made security its “top priority” and has architected its platform to be the most flexible and secure cloud computing environment available.13 This commitment manifests in a shared responsibility model. AWS is responsible for the “security

of the cloud,” which includes protecting the physical infrastructure, hardware, software, and networking that run all AWS services. This is a massive undertaking that individual companies cannot easily replicate.

In turn, customers are responsible for “security in the cloud,” and AWS provides them with a deep set of tools to meet this responsibility. With over 300 security, compliance, and governance services and features, customers have fine-grained control over their environment.13 This includes services like AWS Identity and Access Management (IAM) for granular permissions 8, robust data encryption capabilities both in transit and at rest 17, and network security tools.

Crucially, this security posture is validated by extensive third-party audits. AWS supports 143 security standards and compliance certifications, including HIPAA for healthcare, GDPR for data privacy, and SOC 2 for operational controls.13 By inheriting AWS’s compliance certifications, businesses in highly regulated industries can dramatically simplify their own compliance efforts and accelerate their move to the cloud. This focus on security and compliance builds immense trust and expands AWS’s addressable market to include the most sensitive government, financial, and healthcare organizations.7

Section 5: The State of the Cloud: Market Analysis and Competitive Landscape

The global cloud computing market is a dynamic and fiercely contested arena, characterized by explosive growth and dominated by a handful of technology giants. Within this landscape, Amazon Web Services has maintained its position as the undisputed market leader for over a decade, though its supremacy is continually challenged by formidable competitors.

Market Share Supremacy

According to recent industry analysis from late 2024 and early 2025, AWS commands the largest share of the worldwide cloud infrastructure services market, estimated to be between 30% and 32%.11 This places it significantly ahead of its primary rivals, Microsoft Azure, which holds a market share of approximately 21-23%, and Google Cloud Platform (GCP), with a share around 10-12%.11 Combined, these three “hyperscalers” account for more than two-thirds of the entire market, illustrating their collective dominance.32

The overall market itself is expanding at a remarkable rate. In the fourth quarter of 2024, global spending on cloud infrastructure services reached approximately $91 billion, a year-over-year increase of 22%.31 This rapid growth means that while AWS’s market share percentage has trended down slightly from its peak (e.g., from 33% in late 2022), its absolute revenue continues to soar, reaching $28.8 billion in Q4 2024, a 19% increase from the previous year.32 This dynamic indicates that the cloud market is not a zero-sum game; rather, it is an expanding universe where competitors are capturing portions of massive new growth, even as the leader continues to expand. This has led to an enterprise reality where multi-cloud strategies—using different providers for different workloads—are becoming the norm, forcing providers to compete not just on features but also on interoperability.

The “Big Three” Compared: A Strategic Showdown

While AWS, Azure, and GCP all offer a core set of similar cloud services, they each possess distinct strengths, weaknesses, and strategic focuses that appeal to different customer segments and use cases.

- Amazon Web Services (AWS): As the market pioneer, AWS’s primary strength lies in its maturity, operational experience, and the unparalleled breadth and depth of its service catalog.11 It is the definitive leader in the IaaS segment and boasts the largest and most vibrant ecosystem of customers, partners, and third-party tools.11 Its vast portfolio makes it the default choice for organizations with complex needs and those seeking a one-stop shop for all their cloud requirements.

- Microsoft Azure: Azure’s key competitive advantage is its deep integration with the Microsoft enterprise ecosystem. For the vast number of companies that rely on Windows Server, Office 365, and Active Directory, Azure offers a seamless and familiar path to the cloud.22 It has carved out a strong position in the hybrid cloud market and has been particularly successful in attracting enterprise customers, especially for “light and moderate” cloud workloads.11

- Google Cloud Platform (GCP): GCP differentiates itself through its expertise in specific, high-growth domains. It is widely regarded for its strengths in data analytics, machine learning, artificial intelligence, and container orchestration, leveraging Google’s long history of innovation in these areas.22 GCP often competes aggressively on price and has strong credentials in the open-source community, making it attractive to developers and data-centric organizations.22

Table 3: Competitive Landscape: AWS vs. Azure vs. GCP

| Feature | Amazon Web Services (AWS) | Microsoft Azure | Google Cloud Platform (GCP) |

| Market Share (Q4 2024) | ~30-32% 11 | ~21-23% 11 | ~10-12% 31 |

| Launch Year | 2006 22 | 2010 22 | 2008 22 |

| Number of Services | Over 200+ 13 | Over 200+ 22 | Over 200+ 22 |

| Key Strengths | Broadest/deepest service portfolio, mature ecosystem, first-mover advantage, market leadership. 11 | Seamless integration with Microsoft enterprise software, strong hybrid cloud capabilities, large enterprise footprint. 22 | Expertise in big data, AI/ML, and containers; strong open-source support; often cost-effective. 22 |

| Primary Weaknesses | Can be complex to manage, pricing can be confusing, perceived high cost for some services. 22 | Potential for vendor lock-in with Microsoft ecosystem, less mature in some service areas compared to AWS. 22 | Smaller global footprint and service portfolio compared to AWS and Azure. 22 |

| Pricing Model | Pay-as-you-go, with options for reserved instances and savings plans. Cheaper for general-purpose compute. 1 | Pay-as-you-go, with strong incentives for existing Microsoft enterprise customers. Cheaper for compute-optimized instances. 22 | Pay-as-you-go, with per-second billing and sustained use discounts. Often considered cheaper overall. 22 |

The AWS Customer Universe: From Startups to Global Enterprises

The scale of AWS’s success is reflected in the diversity of its customer base, which comprises millions of active customers across virtually every industry in over 190 countries.14 This wide adoption is a testament to the platform’s versatility.

- Startups: AWS has become the de facto infrastructure platform for the startup world. Companies like Airbnb, Slack, Stripe, and Pinterest were built on AWS, leveraging its pay-as-you-go model and scalability to grow from small ideas into global businesses without needing to build their own data centers.23 In fact, startups and small-to-medium businesses represent the fastest-growing segment of the AWS customer base.23

- Enterprises: The world’s largest and most established companies trust AWS for their mission-critical applications. Approximately 80% of Fortune 500 companies are AWS customers.27 This includes industry leaders such as

Netflix, BMW, Coca-Cola, Johnson & Johnson, and Siemens, who use AWS for everything from global content delivery and manufacturing analytics to pharmaceutical research and supply chain management.23 - Public Sector: Due to its robust security and compliance certifications, AWS is also a trusted provider for government, education, and non-profit organizations. Clients include the U.S. Department of Defense, NASA, the UK Home Office, and numerous universities and research institutions that use the platform for secure data processing, large-scale scientific research, and delivering citizen services.29

Section 6: AWS in Action: Real-World Applications and Transformative Case Studies

The abstract concepts of cloud services and their benefits become tangible when examined through the lens of real-world applications. Across every industry, organizations are leveraging AWS to solve complex business problems, accelerate innovation, and fundamentally reinvent their operations. These high-profile success stories serve not only as proof of the platform’s capabilities but also as a powerful marketing tool, creating a halo effect that validates the technology and reduces the perceived risk for new adopters. When a technology leader like Netflix publicly demonstrates its reliance on AWS, it sends a clear signal to the market about the platform’s readiness for the most demanding workloads.

Powering the Digital Economy’s Titans

Many of today’s most recognizable digital brands were born in the cloud and built their empires on the back of AWS infrastructure.

- Media & Entertainment: The case of Netflix is perhaps the most famous example of a company going “all-in” on AWS. Netflix uses AWS for nearly all of its computing and storage needs, from transcoding petabytes of video content to running the sophisticated recommendation algorithms that personalize the user experience.23 The platform’s global reach and elasticity are what allow Netflix to stream content to hundreds of millions of subscribers worldwide, seamlessly handling massive, spiky traffic patterns, such as during the release of a popular new series.

- Travel & Hospitality: Airbnb relies on AWS to power its global marketplace. The platform uses AWS services to manage its millions of listings, process secure payments, and run the analytics and machine learning models that provide personalized recommendations to its users.27 The scalability of AWS is critical for handling the immense seasonal peaks in traffic that are characteristic of the travel industry.

- Financial Services: In a sector defined by stringent security and regulatory requirements, leading financial institutions like Goldman Sachs and Capital One use AWS to innovate safely.29 They leverage the platform’s secure and compliant environment to run complex risk-management simulations, analyze vast datasets for market insights, and develop new customer-facing fintech applications, all while adhering to strict industry regulations.

Enabling the Future: Cutting-Edge Workloads

Beyond hosting websites and applications, AWS is the platform of choice for organizations working on the cutting edge of technology.

- Artificial Intelligence and Machine Learning (AI/ML): AWS has democratized access to AI and ML. Pfizer, for example, uses AWS to accelerate vaccine development and manufacturing and is now using AWS’s generative AI technology to identify new oncology targets, speeding up critical research.7

Toyota is building a next-generation data lake on AWS, using services like Amazon S3 for storage and Amazon SageMaker to build, train, and deploy ML models that analyze manufacturing data and optimize its supply chain.23 - Big Data and Analytics: The ability to store and analyze massive volumes of data is a core use case for AWS. Organizations across industries use Amazon S3 as a central “data lake” to consolidate structured and unstructured data. They then use services like Amazon Redshift for data warehousing and Amazon Athena for interactive querying to extract business intelligence and drive data-informed decisions.15

- Containers and Microservices: Modern application development often relies on containers and microservices architecture for agility and scalability. Companies like Snap, Vanguard, and Vodafone use AWS’s container orchestration services—such as Amazon ECS, Amazon EKS (for Kubernetes), and AWS Fargate (serverless containers)—to build, deploy, and run their applications more quickly and reliably. These services automate infrastructure management, improve resource utilization, and have been shown to dramatically reduce developer effort for launching new services.36

Table 4: Prominent AWS Customers and Use Cases by Industry

| Industry | Company | Primary AWS Use Case |

| Media & Entertainment | Netflix, Walt Disney | Global video streaming infrastructure, content delivery, data analytics, recommendation engines. 23 |

| Tech & Startups | Airbnb, Slack, Reddit | Scalable web application hosting, secure payment processing, real-time data processing, personalized user experiences. 27 |

| Financial Services | Goldman Sachs, Capital One, NASDAQ | Secure financial data processing, risk management analytics, fraud detection, development of fintech applications. 7 |

| Healthcare & Life Sciences | Pfizer, Johnson & Johnson, Moderna | Pharmaceutical research and development, clinical trial data management, vaccine development, secure healthcare data storage (HIPAA compliance). 7 |

| Retail & E-Commerce | Zalando, McDonald’s, Target | E-commerce platforms, supply chain analytics, customer insights, managing point-of-sale data. 27 |

| Manufacturing | BMW, Siemens, Toyota | IoT data collection from factory floors, supply chain optimization, predictive maintenance, big data analytics for manufacturing processes. 23 |

| Public Sector | NASA, U.S. Department of Defense | Large-scale scientific computing, secure data storage for sensitive government information, public-facing digital services. 29 |

| Gaming | Epic Games, Riot Games | Hosting massively multiplayer online games, real-time game data analytics, global content delivery for game updates. 29 |

Section 7: Strategic Considerations and Inherent Challenges

While the benefits of Amazon Web Services are compelling, a comprehensive analysis requires a clear-eyed assessment of its inherent challenges and strategic risks. For any organization, adopting AWS is a significant commitment that involves navigating complexities in cost, architecture, and talent. Critically, these challenges are often the direct and unavoidable consequences of the platform’s greatest strengths—its vast scale, integrated ecosystem, and market leadership. Understanding this duality is essential for making informed strategic decisions.

Navigating the Cost Labyrinth: The Complexity of Pricing

The pay-as-you-go model is a primary driver of AWS adoption, but its implementation is notoriously complex. The AWS pricing structure can be a significant challenge, especially for organizations new to the cloud.24 The final monthly bill is a composite of charges from dozens of different services, each with its own unique pricing model (e.g., per-hour for compute, per-gigabyte for storage, per-request for serverless functions). This is further complicated by additional costs for data transfer between regions, tiered pricing levels, and charges for premium support.30

This complexity makes it difficult for businesses to accurately forecast their cloud spending. Without diligent monitoring and governance, organizations can easily face unexpected costs, a phenomenon often referred to as “bill shock”.24 The very breadth of the service catalog, a key strength, directly contributes to this pricing complexity. Consequently, effective cost management on AWS has become a specialized discipline in itself (often called FinOps), frequently requiring dedicated experts or third-party cost optimization tools to ensure that the economic benefits of the cloud are fully realized.24

The Golden Handcuffs: The Risk of Vendor Lock-In

One of the most significant strategic risks associated with deep adoption of AWS is vendor lock-in.30 This challenge stems directly from the strength of AWS’s deeply integrated ecosystem. As customers build their applications using AWS’s proprietary, high-value services—such as AWS Lambda for serverless logic, Amazon DynamoDB for NoSQL data, or Amazon SageMaker for machine learning—they become increasingly dependent on the AWS platform.30

Migrating these applications to another cloud provider or back to an on-premises environment becomes technically challenging, time-consuming, and expensive.30 The process would often require a complete re-architecture of the application to replace the AWS-specific services with alternatives. This high switching cost creates a powerful “stickiness” that benefits AWS by ensuring customer retention but limits a customer’s long-term flexibility and negotiating leverage. Thus, the seamless integration that provides so much value and agility is the very mechanism that creates the “golden handcuffs” of vendor lock-in.

The Human Element: The Steep Learning Curve and Talent Gap

The immense power and flexibility of the AWS platform come at the cost of complexity. With over 200 services, each with its own set of configurations and best practices, the platform presents a steep learning curve for developers and IT professionals.30 Effectively managing, securing, and optimizing a sophisticated AWS environment requires specialized technical expertise.30

This has created a significant talent gap in the industry. The demand for experienced and AWS-certified professionals far outstrips the supply, making it both difficult and expensive for companies to hire the talent they need.24 This shortage can become a major bottleneck, preventing organizations from fully leveraging the platform’s capabilities or leading them to misconfigure services, which can result in security vulnerabilities or cost overruns. The market leadership of AWS, a clear strength, is the direct cause of this highly competitive market for talent.

Operational Realities: Regional Limits and Dependencies

While AWS’s global infrastructure is a major asset, there are operational realities that customers must manage. AWS imposes default service limits or “quotas” on the number of resources a customer can provision in a given region (e.g., a limit on the number of EC2 instances).24 These limits are intended as safeguards to prevent accidental over-provisioning, but they can require customers to proactively request increases, which can sometimes introduce delays.24

Furthermore, not all AWS services are available in all geographic regions. Newer or more specialized services are often rolled out in major regions first, which can be a limitation for businesses that have specific data residency requirements or need to operate in a region where a key service is not yet available.24 Finally, like any cloud service, AWS is fundamentally dependent on reliable internet connectivity. For businesses operating in locations with poor or unstable internet access, latency and connectivity issues can pose a significant operational challenge.30

Section 8: Conclusion: The Future of AWS and Strategic Recommendations

Amazon Web Services has not only pioneered the cloud computing industry but has also established itself as its enduring and dominant force. Its success is a case study in strategic vision, relentless innovation, and the creation of a powerful, self-reinforcing business ecosystem. By transforming IT infrastructure into a scalable, on-demand utility, AWS has fundamentally altered the competitive landscape, empowering a generation of digital-native companies and enabling established enterprises to reinvent themselves. Its popularity is not a fleeting trend but the result of a deeply integrated value proposition that combines economic flexibility, operational agility, a comprehensive service portfolio, and a trusted foundation of security and reliability.

Sustaining Leadership in the Era of AI and Multi-Cloud

Looking forward, the cloud market continues to evolve at a breakneck pace. While AWS remains the clear leader, its position is not immutable. The current technological inflection point is the rise of generative artificial intelligence, which has become the new primary battleground for the cloud giants.32 AWS is investing heavily to maintain its innovation edge in this domain, rolling out services like Amazon Bedrock, which provides access to a range of foundation models, and Amazon Q, an AI-powered assistant for business.20 Its ability to integrate these AI capabilities seamlessly into its broader ecosystem will be critical to sustaining its leadership.

Simultaneously, the strategic adoption of multi-cloud architectures by large enterprises is becoming the norm. This trend suggests that the future is not about a single winner taking all, but about customers leveraging the unique strengths of different providers. For AWS, this means the competitive landscape will increasingly be defined not just by the features within its walled garden, but also by its ability to support hybrid environments (like with AWS Outposts) and provide seamless interoperability with workloads running on other clouds and on-premises data centers.

Strategic Imperatives for Cloud Adopters

For business and technology leaders, navigating the AWS ecosystem is a strategic endeavor that requires more than just technical acumen. To maximize the value of the cloud while mitigating its inherent risks, organizations should consider the following high-level imperatives:

- Develop a Cloud Strategy, Not Just a Cloud Presence: Avoid adopting cloud technology for its own sake. The most successful cloud journeys are driven by clear business objectives. Organizations must develop a holistic strategy that defines what they want to achieve—be it cost reduction, increased agility, market expansion, or product innovation—and then align their AWS architecture and service choices to meet those specific goals.

- Embrace FinOps and Cost Governance: The complexity of AWS pricing necessitates a proactive and disciplined approach to financial management. Organizations should establish a culture of cost accountability and implement FinOps (Cloud Financial Operations) best practices. This includes leveraging AWS-native tools like AWS Budgets and Cost Explorer to monitor spending, setting alerts for cost anomalies, and continuously optimizing resource usage to ensure a strong return on investment.12

- Invest in People and Skills: The technology is only as effective as the people who manage it. Addressing the AWS skills gap is a critical imperative. This involves a dual approach: investing in continuous training and certification for internal teams to build in-house expertise, and, where necessary, forming strategic partnerships with certified AWS consultants or managed service providers who can provide specialized knowledge and accelerate adoption.24

- Architect for Resilience and Flexibility: A core benefit of AWS is its toolset for building highly resilient and available systems. Organizations should architect their applications from the ground up to leverage multi-AZ and multi-region capabilities to ensure fault tolerance. At the same time, they must be deliberate about managing vendor lock-in. For core, business-differentiating workloads, this may involve using open-source technologies and architectural patterns that remain portable, ensuring long-term strategic flexibility even while taking advantage of the power of the AWS platform.

Now you have enough knowledge about Amazon AWS, let’s explore the most fundamental building block “What is AWS EC2? Your First Introduction to Cloud Servers“

Section 9: Frequently Asked Questions (FAQs) about Amazon Web Services (AWS)

1. What is AWS and what is it used for?

Amazon Web Services (AWS) is a cloud computing platform that provides over 200 on-demand technology services over the internet. Instead of buying and managing their own physical servers, organizations can use AWS for a wide range of tasks, including hosting websites, running enterprise software, storing and backing up data, processing big data, and developing cutting-edge applications using AI and machine learning.

2. What are the main advantages of using AWS?

According to the report, the primary advantages are:

- Economic: It changes large, upfront hardware costs into a variable, pay-as-you-go operational expense.

- Agility & Speed: It allows companies to deploy new resources in minutes instead of weeks, accelerating innovation.

- Scalability: It enables resources to automatically scale up or down to match real-time demand, ensuring performance and eliminating waste.

- Breadth of Services: It offers the most comprehensive portfolio of services, allowing businesses to build almost anything on a single platform.

What is the difference between IaaS, PaaS, and SaaS?

These are the three main models of cloud computing:

- IaaS (Infrastructure as a Service): Provides the fundamental building blocks like virtual servers (EC2) and storage (S3). You manage the operating system and applications.

- PaaS (Platform as a Service): AWS manages the underlying hardware and operating systems, so you can focus only on deploying and managing your applications.

- SaaS (Software as a Service): A complete, ready-to-use application managed by the provider, which you typically access through a web browser.

4. Is AWS expensive?

It can be complex. While the pay-as-you-go model can be very cost-effective, the report highlights that the pricing structure is intricate. Without careful management and cost governance (a practice known as FinOps), organizations can experience unexpected high costs or “bill shock.” It has happened with me multiple times so be careful ;).

5. What is “vendor lock-in” and why is it a concern with AWS?

Vendor lock-in refers to the difficulty and expense of moving applications from one cloud provider to another. As organizations build applications using AWS’s specific, high-value services (like AWS Lambda or Amazon DynamoDB), their technology becomes deeply integrated with the AWS platform. This makes it challenging to switch to a competitor, reducing long-term flexibility and negotiating power.

6. Who are some of the biggest companies that use AWS?

The report mentions that millions of customers use AWS, including 80% of Fortune 500 companies. Prominent examples include Netflix, Airbnb, Pfizer, BMW, Goldman Sachs, and Epic Games.

7. What are the main competitors to AWS?

The main competitors are Microsoft Azure and Google Cloud Platform (GCP). While AWS is the market leader with around 31% market share, Azure holds about 22% and GCP has about 11%.

Works cited

- Cloud Computing Explained: AWS Overview, accessed June 29, 2025, https://aws.amazon.com/awstv/watch/d33fa5c7646/

- What is Cloud Computing? – Cloud Computing Services, Benefits …, accessed June 29, 2025, https://aws.amazon.com/what-is-cloud-computing/

- The History of AWS and the Evolution of Computing | Medium – Neal Davis, accessed June 29, 2025, https://neal-davis.medium.com/the-history-of-aws-and-the-evolution-of-computing-0a64cee5bc15

- A Brief History Of AWS – And How Computing Has Changed – Digital Cloud Training, accessed June 29, 2025, https://digitalcloud.training/a-brief-history-of-aws-and-how-computing-has-changed/

- SaaS vs PaaS vs IaaS – Types of Cloud Computing – AWS, accessed June 29, 2025, https://aws.amazon.com/types-of-cloud-computing/

- Our Origins – AWS – Amazon.com, accessed June 29, 2025, https://aws.amazon.com/about-aws/our-origins/

- Our Customers and Partners – AWS, accessed June 29, 2025, https://aws.amazon.com/about-aws/our-customers-and-partners/

- AWS Cloud Computing Models – SaaS, IaaS, and PaaS – HubSpot, accessed June 29, 2025, https://cdn2.hubspot.net/hubfs/1629777/A%20Comprehensive%20Guide%20on%20AWS%20as%20SaaS_IaaS_and_PaaS.pdf

- PaaS vs IaaS vs SaaS: What’s the difference? – Google Cloud, accessed June 29, 2025, https://cloud.google.com/learn/paas-vs-iaas-vs-saas

- What Are IaaS, PaaS and SaaS? – IBM, accessed June 29, 2025, https://www.ibm.com/think/topics/iaas-paas-saas

- 2024 Cloud Market Share Analysis: Decoding Cloud Industry Leaders, accessed June 29, 2025, https://www.hava.io/blog/2024-cloud-market-share-analysis-decoding-industry-leaders-and-trends

- AWS Services Overview: Core Components – AWS for Engineers, accessed June 29, 2025, https://awsforengineers.com/blog/aws-services-overview-core-components/

- What is AWS? – Cloud Computing with AWS – Amazon Web Services, accessed June 29, 2025, https://aws.amazon.com/what-is-aws/

- What is AWS? An Introduction to Amazon Web Services – DataCamp, accessed June 29, 2025, https://www.datacamp.com/blog/what-is-aws

- AWS Services Demystified: Understanding EC2, S3, and RDS – NashTech Blog, accessed June 29, 2025, https://blog.nashtechglobal.com/ec2-s3-and-rds/

- Understanding AWS Core Services: EC2, S3, RDS, and Lambda – QAInsights, accessed June 29, 2025, https://qainsights.com/understanding-aws-core-services-ec2-s3-rds-and-lambda/

- 3 most commonly used AWS services – S3,EC2,RDS – DEV Community, accessed June 29, 2025, https://dev.to/mrcaption49/3-most-commonly-used-aws-services–1in2

- AWS services EC2 | S3 | RDS | Lambda Function | VPC – DEV Community, accessed June 29, 2025, https://dev.to/mrcaption49/aws-services-ec2-s3-rds-lambda-function-vpc-bbi

- AWS Core Services: What You Need To Know – Clarusway, accessed June 29, 2025, https://clarusway.com/aws-core-services/

- Timeline of Amazon Web Services – Wikipedia, accessed June 29, 2025, https://en.wikipedia.org/wiki/Timeline_of_Amazon_Web_Services

- How and When AWS Cloud Started: A Brief History – Sedmi odjel, accessed June 29, 2025, https://www.sedmiodjel.com/blog/cloud-migration/how-and-when-aws-cloud-started-a-brief-history

- AWS vs Azure vs Google Cloud in 2025: Cloud Comparison, accessed June 29, 2025, https://www.cloudwards.net/aws-vs-azure-vs-google/

- spacelift.io, accessed June 29, 2025, https://spacelift.io/blog/who-is-using-aws

- Advantages and Disadvantages of AWS: Business Impact – CrossAsyst, accessed June 29, 2025, https://crossasyst.com/blog/aws-advantages-and-disadvantages/

- History of Amazon Web Services – Jerry Hargrove – AWS Geek, accessed June 29, 2025, https://www.awsgeek.com/AWS-History/

- 5 Amazing Benefits of AWS (And 3 Drawbacks) for Your Business – SADOS, accessed June 29, 2025, https://sados.com/blog/aws-benefits-and-drawbacks/

- List of Companies Using AWS | AWS Customers List – InfoCleanse, accessed June 29, 2025, https://www.infocleanse.com/business-data/technology-customers-list/aws-customers-list/

- Cloud Computing Services – Amazon Web Services (AWS), accessed June 29, 2025, https://aws.amazon.com/

- Companies using Amazon Web Services (AWS) – GeeksforGeeks, accessed June 29, 2025, https://www.geeksforgeeks.org/devops/companies-using-amazon-web-services-aws/

- AWS Cloud Advantages and Disadvantages – Folio3 Cloud Services, accessed June 29, 2025, https://cloud.folio3.com/blog/benefits-of-aws/

- Amazon and Microsoft Stay Ahead in Global Cloud Market – Statista, accessed June 29, 2025, https://www.statista.com/chart/18819/worldwide-market-share-of-leading-cloud-infrastructure-service-providers/

- AWS, Microsoft, Google Fight For $90B Q4 2024 Cloud Market Share – CRN, accessed June 29, 2025, https://www.crn.com/news/cloud/2025/aws-microsoft-google-fight-for-90b-q4-2024-cloud-market-share

- Cloud Market Share Q1 2025: AWS Dips, Microsoft And Google Show Growth – CRN, accessed June 29, 2025, https://www.crn.com/news/cloud/2025/cloud-market-share-q1-2025-aws-dips-microsoft-and-google-show-growth

- What is Amazon Web Services (AWS)? – help.illinois.edu, accessed June 29, 2025, https://help.uillinois.edu/TDClient/37/uic/KB/ArticleDet?ID=2404

- Customer Success Stories: Case Studies, Videos, Podcasts … – AWS, accessed June 29, 2025, https://aws.amazon.com/solutions/case-studies/

- Customers – AWS, accessed June 29, 2025, https://aws.amazon.com/containers/customers/

- Advantages and limitations of embracing AWS as a cloud infrastructure – Hystax, accessed June 29, 2025, https://hystax.com/advantages-and-limitations-of-embracing-aws-as-a-cloud-infrastructure/

- Why AWS ?? ….Advantages and Disadvantages. | by Ankit Gupta | Analytics Vidhya, accessed June 29, 2025, https://medium.com/analytics-vidhya/why-aws-advantages-and-disadvantages-f0e666b869b3